Bond 2022

Bond 2022 Major Projects

Bond Election May 7, 2022

Voters passed Humble ISD Bond 2022. Harris County has completed the ballot count from all precincts.

Proposition A, the facilities proposition, was approved 64 percent to 36 percent.

Proposition B, the technology proposition, was approved 64 percent to 36 percent.There were more than 12,000 votes cast. Detailed information is available on the Harris County website.

Thank you to everyone who participated in the election by voting during Early Voting or on Election Day, Saturday, May 7, 2022.

Growth

Humble ISD is a Fast Growth District

This school year we have seen an increase of 2,700 students. Bond 2022 is focused on growth so that campuses can accommodate increasing student enrollments.

Renewal

Some Humble ISD Schools Were Built Decades Ago

Bond 2022 is focused on renewal so that children who live in established neighborhoods, where schools were built years ago, experience educational facilities that are comparable to the schools built more recently in newer neighborhoods.

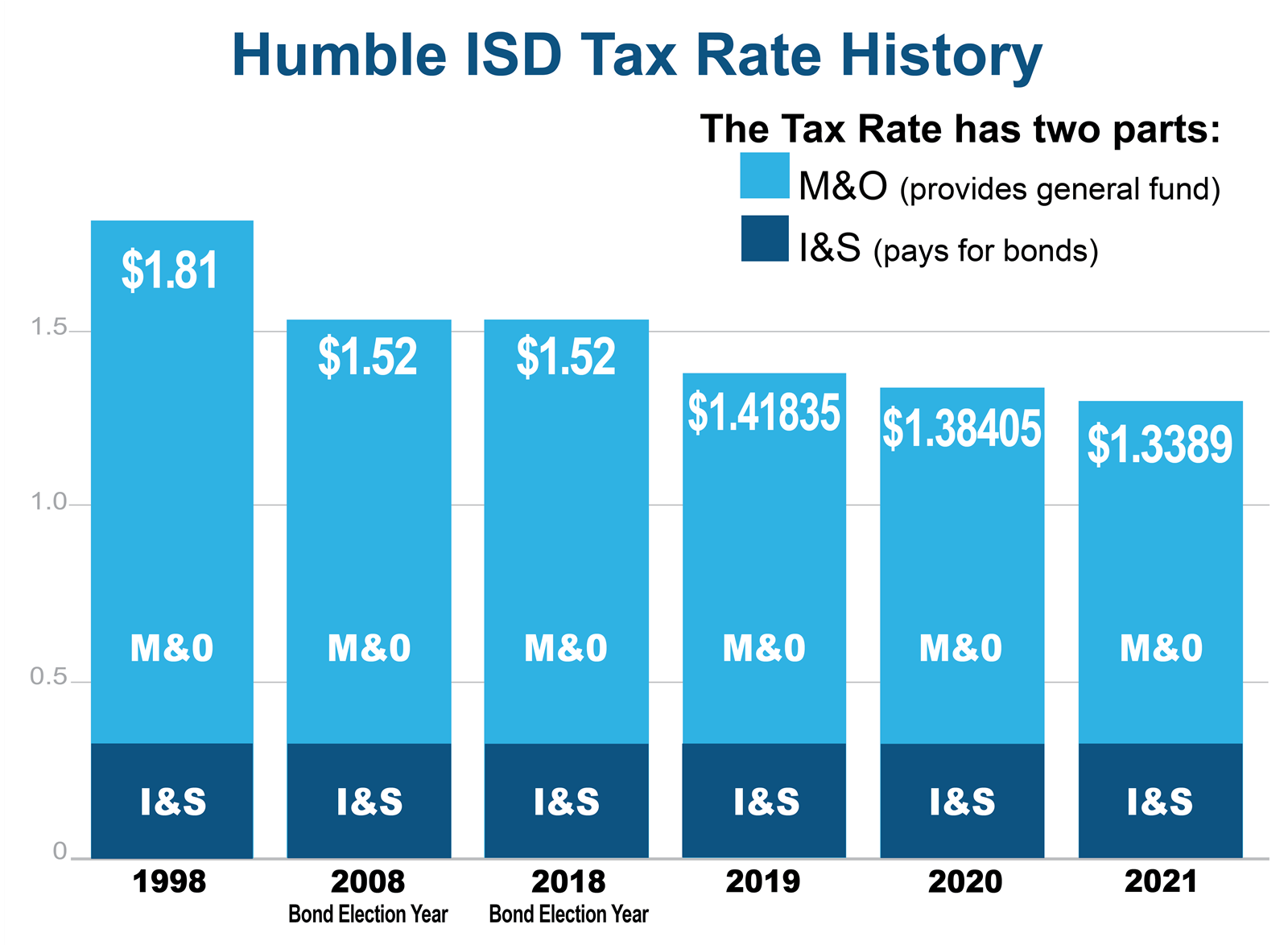

There Will Be No Tax Rate Increase as a Result of Bond 2022

Humble ISD can issue bonds and not raise the tax rate

Two factors come together to enable Humble ISD to issue bonds without raising the property tax rate. First, Humble ISD is a fast growing district. As new homes are constructed, new businesses open, and existing property values rise, Humble ISD’s total tax value base grows, allowing the district to collect more tax revenue without increasing the tax rate. Property value growth has allowed the School Board to lower the tax rate three times since the 2018 bond referendum. Second, Humble ISD retires debt annually. Humble ISD does not plan to sell bonds until property value growth and payments toward existing debt allow the district to do so without raising the debt service tax rate.

Humble ISD’s Projected Tax Rate for 2022 is lower than the current tax rate

Anticipating 6 percent property value growth, Humble ISD projects the M&O tax rate can be lowered by 2 cents in 2022 based on current projected values and no change in the state formula for school funding. Humble ISD plans to keep the I&S tax rate at 35 cents, the same as it has been since 2008.

Bond 2022 Proposed Projects

Bond 2022 Would Preserve General Funds for Teacher Raises

When a district has bond funds available, capital expenses such as air-conditioning, roof replacements and buses can be paid out of those bond funds. When a district does not have bond funds available, all expenses must be paid out of the general fund or from other sources. This depletes these revenue sources, leaving less money available for all other expenditures, such as teacher raises, new teacher positions, benefits, and student programs. Approximately 85% of the general fund is allocated to salaries and benefits of staff. Reallocating general funds for these types of capital improvements would reduce the funds available for raises.

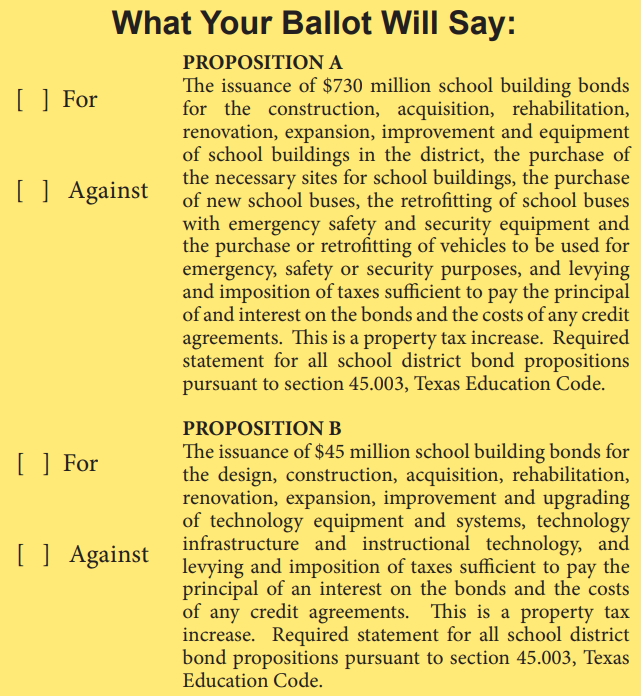

What Your Ballot Will Say

Proposition A

The issuance of $730 million school building bonds for the construction, acquisition, rehabilitation, renovation, expansion, improvement and equipment of school buildings in the district, the purchase of the necessary sites for school buildings, the purchase of new school buses, the retrofitting of school buses with emergency safety and security equipment and the purchase or retrofitting of vehicles to be used for emergency, safety or security purposes, and levying and imposition of taxes sufficient to pay the principal of and interest on the bonds and the costs of any credit agreements. This is a property tax increase. Required statement for all school district bond propositions pursuant to section 45.003, Texas Education Code.

Proposition B

The issuance of $45 million school building bonds for the design, construction, acquisition, rehabilitation, renovation, expansion, improvement and upgrading of technology equipment and systems, technology infrastructure and instructional technology, and levying and imposition of taxes sufficient to pay the principal of an interest on the bonds and the costs of any credit agreements. This is a property tax increase. Required statement for all school district bond propositions pursuant to section 45.003, Texas Education Code.

NO TAX RATE INCREASE

In compliance with new state law, bond ballot propositions must include the following statement: This is a property tax increase. Voters will see this language on all bond propositions; however, Humble ISD plans to keep the I&S tax rate at 35 cents, the same as it has been since 2008.

Five tax exemptions are available

$25,000 homestead exemption; additionally, a $15,000 age 65 and older exemption; $10,000 Disabled Homestead exemption, a $5,000 to $12,000 Disabled Veteran or Survivor exemption; and a 100% homestead exemption for certain qualifying disabled veterans. A tax deferral is available for homeowners with an Over 65 or Disabled exemption.

Additionally, the May 7 ballot includes a statewide ballot proposition to allow for those with elderly or disabled homestead exemptions to have their tax ceiling reduced if the school tax rate is lowered, and to increase the homestead exemption from $25,000 to $40,000 for everyone who claims the homestead exemption. Humble ISD’s plan to maintain or lower the current tax rate takes into account the possibility of the homestead exemption going to $40,000. Humble ISD voters can vote on the statewide ballot propositions when they vote on Bond 2022 Propositions A and B.

Humble ISD’s bond rating is among the strongest in the State of Texas for public school districts

School districts are evaluated by ratings agencies to determine creditworthiness. Humble ISD received an AA rating from Standard & Poor’s (S&P) and an Aa1 rating from Moody’s Investors Service in 2021. This is equal to or higher than 98% of Texas public school districts.

“The Aa1 rating reflects the district’s growing economy in the Houston metropolitan area, with favorable resident income indices and a growing enrollment base even during the ongoing pandemic. The district’s stable finances have resulted in the buildup of healthy liquidity and reserves,” Moody’s news release stated. “The stable outlook reflects our expectation that the district will continue to exhibit sound financial management and maintain healthy general reserves.”

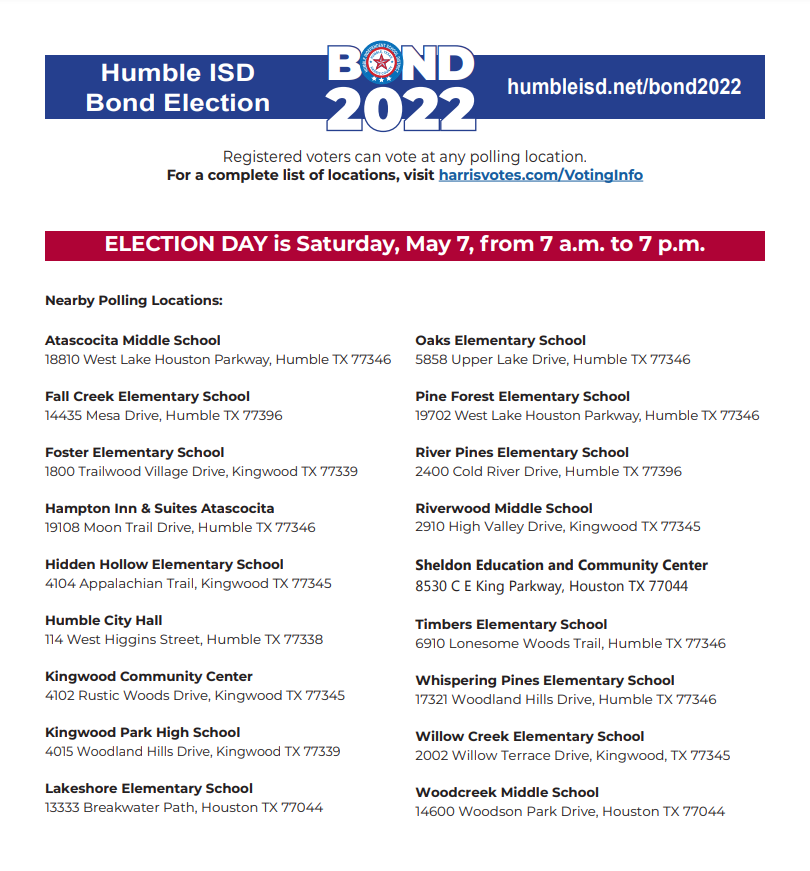

Early Voting: Monday, April 25 - Tuesday, May 3

Election Day: Saturday, May 7

Polling Locations for Early Voting & Election Day

When & Where to Vote

Registered voters can vote at any polling location.

For a complete list of locations, visit Harris Votes Website

Social Media

Videos

Middle School #11

Mosaic Project

Career & Technical Education Updates

Humble High School Renovations

Summer Creek High School Expansion

Foster Elementary

Playgrounds & Outdoor Fitness

Daylighting

Baseball & Softball Turf